Looks like Bitcoin is trading off Japan's bond chart right now.

Japan's 10y JGB yield is around 1.9%, the 2y year is near 1%, the highest since 2008, and the 30y is hovering near ATHs. As Japan effectively enters a "1% era," BTC sold off right as Tokyo cash equities opened.

We've seen this story before:

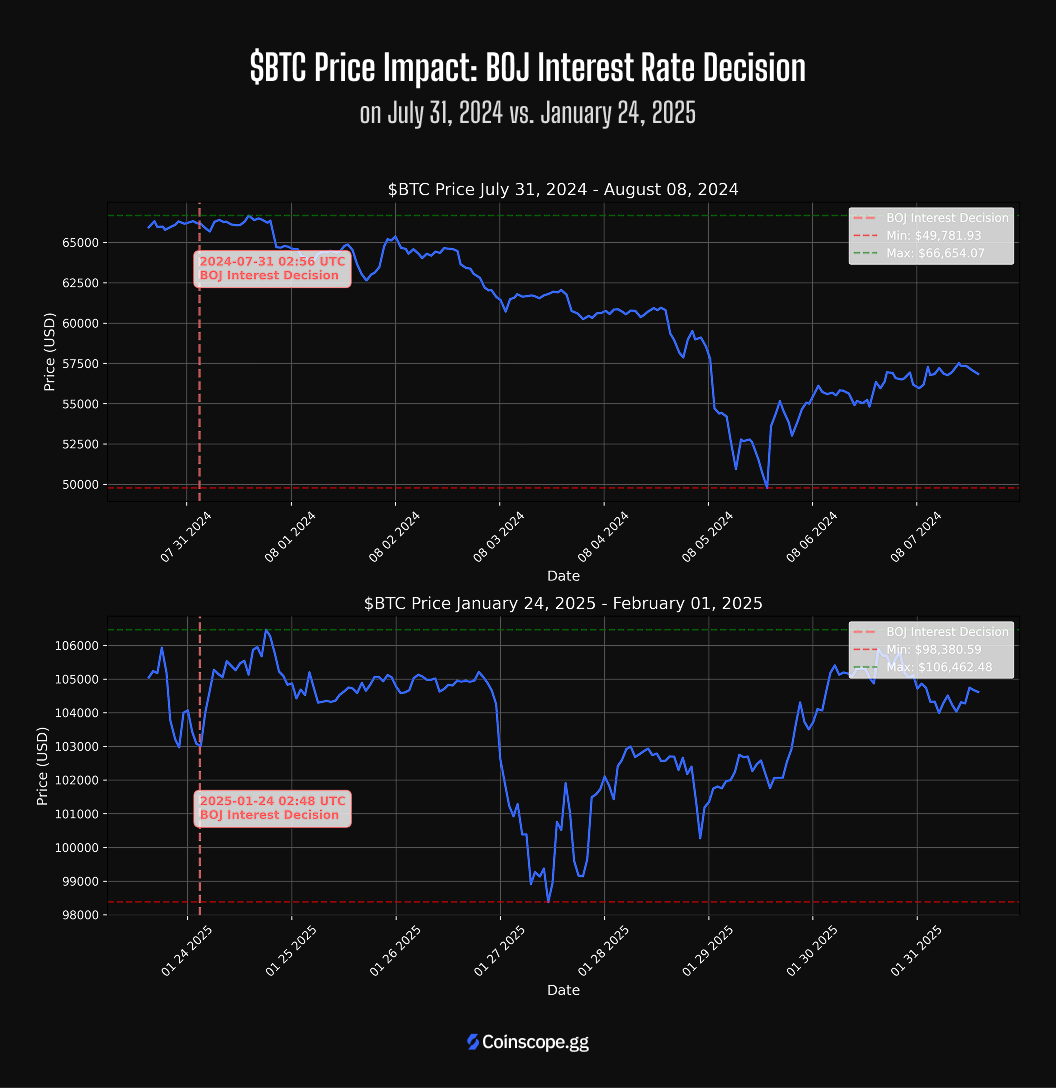

- July 31, 2024: BoJ hikes from 0% to 0.25%

- August 5, 2024: fear of a yen carry unwind hits, and BTC slides from $70k to the low $50k in about a week.

But on January 24, 2025, when BoJ went from 0.25% to 0.5%, the story was different.

The move was largely priced in, and BTC remained relatively stable around the $100k area instead of replaying the plunge.

So the question is whether the December BoJ meeting will look more like August 2024 or January 2025.

Key dates to watch:

- BoJ Policy Meeting: December 18-19

- Rate decision expected: December 19, 03:00 UTC

- Consensus so far: 0.5% -> 0.5% (no change)