Bittensor(@opentensor)'s first $TAO halving is approaching, with most on-chain projections placing it around December 12-14, 2025. It will cut daily issuance by half and marks the first major adjustment to TAO’s emission schedule since launch.

$TAO halving mechanics

- Max supply: 21,000,000 TAO (BTC-style)

- Current phase: 1 TAO/block, ~7,200 TAO/day

- First halving trigger: when total issued supply reaches 10.5M TAO

- After the halving: 0.5 TAO/block, ~3,000 TAO/day

After the halving, assuming the reward split stays the same, validators, subnet operators, and delegators will all earn roughly 50% fewer TAO for the same stake and work. This can push low-margin validators and weaker subnets to exit, while stake migrates toward more efficient operators, leading to short-term changes in subnet quality and uptime. In effect, the halving functions as a live stress test of Bittensor’s incentive design.

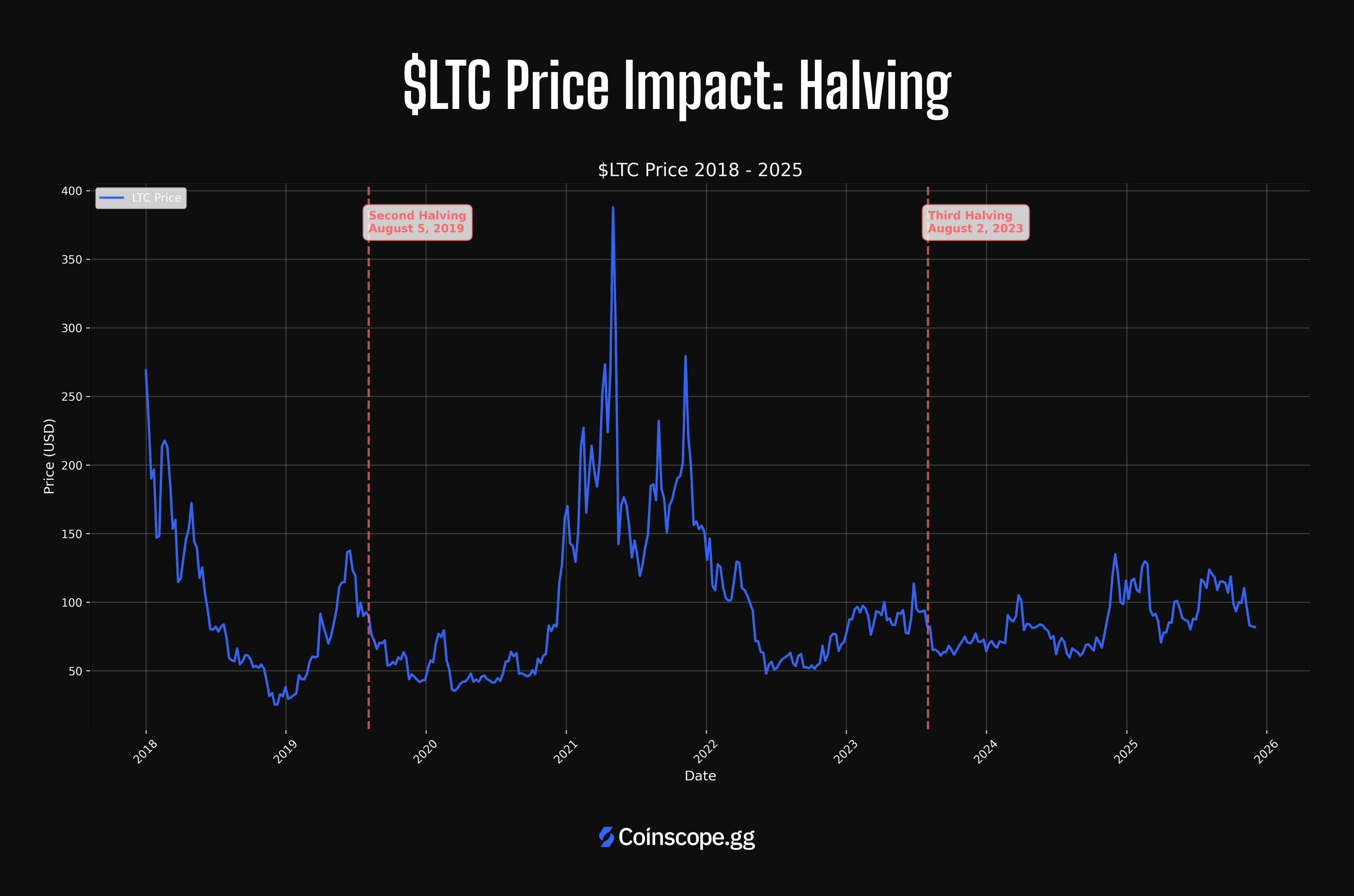

Altcoin halving case: Litecoin $LTC

Litecoin has gone through three halvings (2015, 2019, 2023):

- 2015 halving: strong rally in the months before the event, from low single-digits to around $8, followed by a period of consolidation rather than immediate sustained uptrend.

- 2023 halving: price strength peaked weeks before the date; the halving window itself coincided with correction and lower prices afterward.

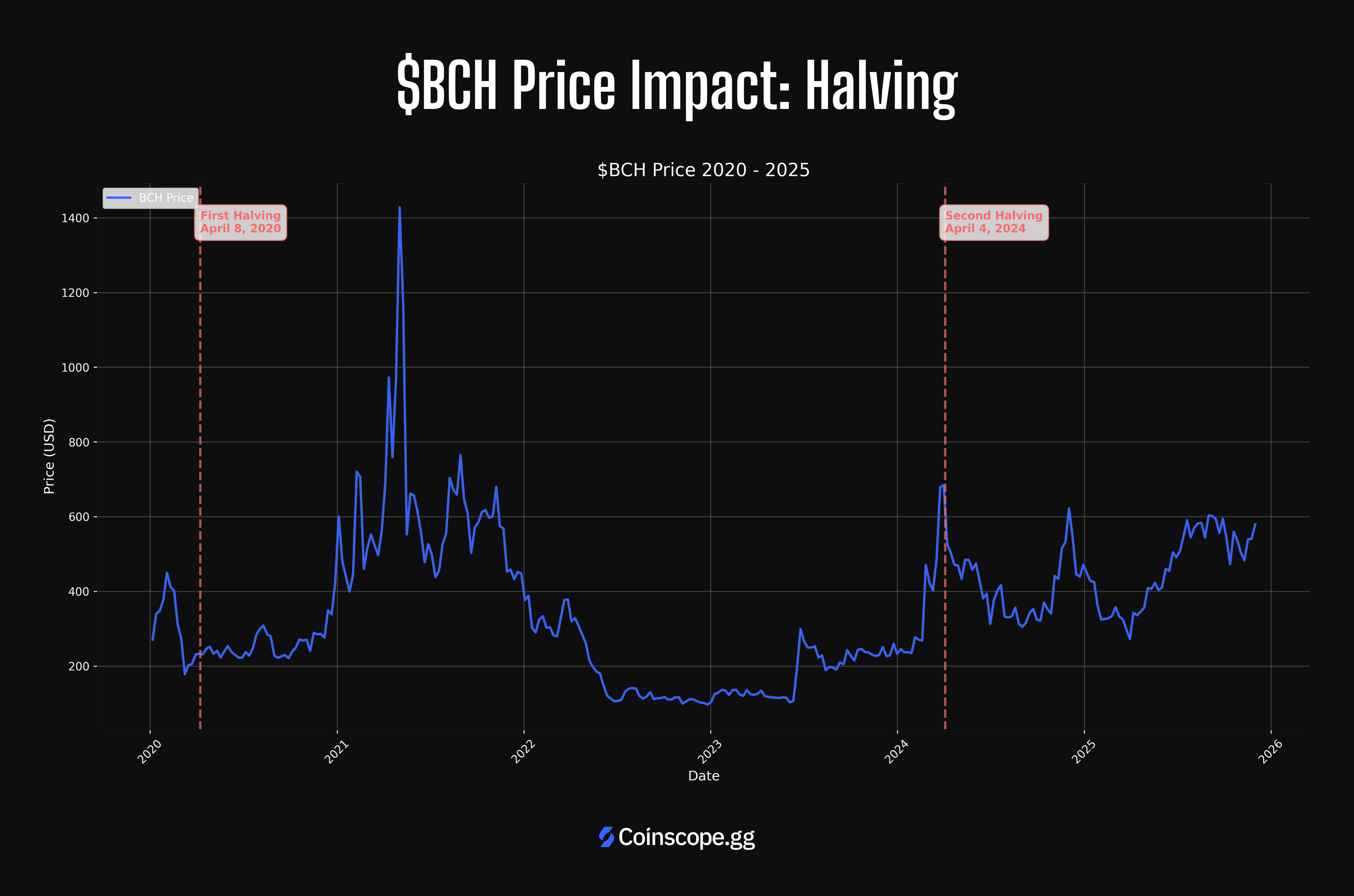

Altcoin halving case: Bitcoin Cash $BCH

- First halving (April 8, 2020): in the ~3 months leading up, BCH saw a sizable percentage rise; around the event itself, price action was volatile and largely faded afterward.

- Second halving (April 4, 2024): the immediate window showed sharp short-term volatility (including a double-digit drop around the day) rather than a clean, one-way trend.

Here again, halvings have functioned more as short-term volatility catalysts than as guarantees of a long, uninterrupted uptrend.

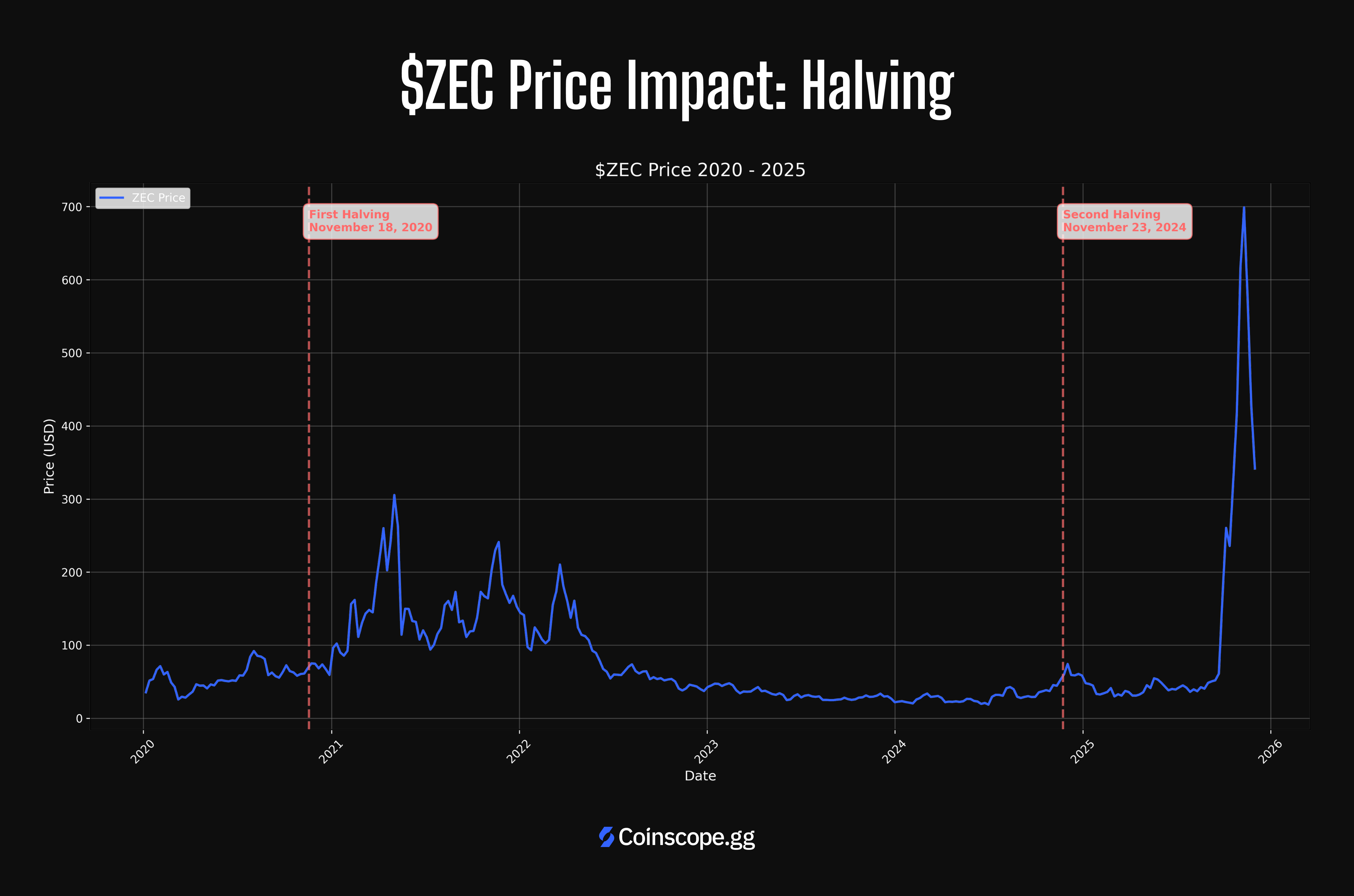

Altcoin halving case: Zcash $ZEC

-

First halving (Nov 18, 2020): block rewards were cut from 6.25 to 3.125 ZEC.

In ZEC’s case, the more pronounced price moves tended to cluster around protocol or governance changes (such as dev fund updates), major network upgrades, and institutional product launches, rather than around the halving date alone.

How to frame the TAO halving

For $TAO, the halving:

- Reduces daily issuance from ~7,200 to ~3,600 TAO, lowering inflation and theoretical sell pressure

- Forces a repricing of incentives for validators, subnets, and delegators, which can reshape the network’s topology and service quality.

Historical altcoin examples (LTC, BCH, ZEC) suggest:

- Halvings often drive pre-event rallies and event-week volatility

- Long-term performance depends more on fundamentals, usage, and narrative than on the emission schedule alone.

All of our posts, including this thread, are for informational purposes only and do not constitute investment advice.